The costs and impact of SOX 404(b) -- which requires auditor review of internal controls over financial reporting -- was the subject of an SEC study published on April 22, 2011.

Tags: Internal Controls, 404, 404 audit, Non-accelerated filer 404(b) information

Internal Controls: Response to Capital Market Regulation Needs an Overhaul

Hal. S. Scott published an article today entitled "Capital Market Regulation Needs an Overhaul" located via this link:

Tags: Internal Controls, Sarbanes-Oxley Articles & Information, SOX, Non-accelerated filer 404(b) information, Wall Street Reform, internal control, Sarbanes-Oxley, external auditing

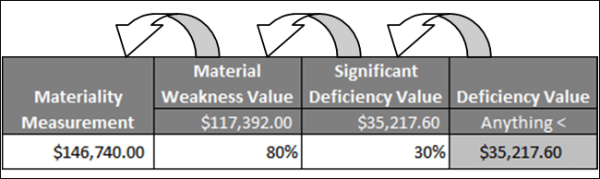

An internal control deficiency can be caused by a number of issues but it is primarily defined as an error discovered during internal controls testing (e.g., a payment was coded to utilities when it should have been coded to inventory) or during a review of the internal control evidence (e.g., the internal or external auditors discover the coding mistake rather than management finding it as part of their closing activities). An internal control deficiency may also occur simply from someone forgetting to execute one of their internal controls entirely.

Tags: Internal Controls, Compliance tools, risk assessment, audit, SOX, 404 audit, best-practice, Controls Testing, 10k, Product Information, Sarbanes-Oxley Training, compliance, risk management, Sarbanes-Oxley, audit deficiency, Internal Control Deficiency

Background

The Wall Street Reform and Consumer Protection Act of 2010 – passed in July 2010 -- permanently exempted non-accelerated filers (public companies with a market cap <$75M) from Sarbanes-Oxley, Section 404(b), which requires an external audit review of a company’s internal controls over financial reporting. Instead, non-accelerated filers can continue to “self-certify” the adequacy of their internal controls under the requirements of Sarbanes-Oxley, section 404(a).

Tags: Internal Controls, 404, Sarbanes-Oxley

I thought it would be interesting to review the lessons proffered from Sam E. Antar - the former CFO of Crazy Eddie, Inc. His website is whitecollarfraud.com and he has some pointed things to say about internal controls and Sarbanes-Oxley. And he should know, as one of the co-conspirators of an amazingly complex fraud scheme that made his family nearly $100 million in the 1980's - long before Enron, Tyco, and WorldCom.

Tags: Internal Controls, SOX, 404 audit, fraud