Vibato Financial Risk Assessment

Learn how to take charge of your audit.Our products are not for just large, medium, or small companies, they are for your size company.

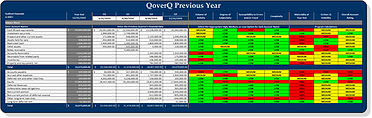

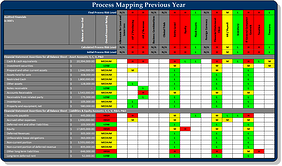

Get a fast, effective way to identify and categorize your areas of highest risk around internal control over financial reporting.

The Vibato Financial Risk Assessment Tool™ provides you with a complete approach to defining and defending the areas of risk within your organization using simple, logical, and easy to understand guidance. The Tool leverages quantitative calculations along with your subjective inputs to paint your companies risk picture is clear terms. The output of this tool can be used in negotiations with your external auditors about your audit scope. No one knows your company as well as you do, why leave the definition of your audit scope to someone who is incentivized to make your audit as large as possible?

How You Will Benefit

- Save time. Complete a financial risk assessment in just one day.

- Save money. Adopt an affordable, tool-based approach that can be utilized continuously to focus on only the highest risks.

- Improve audit efforts. Reduce the cost and scope of your audit and SOX compliance effort by establishing your position on your business risks with your auditors.

- Improve financial risk management. Gain a methodical, easy-to-use way to identify and categorize your business risks, so that you can mitigate them appropriately.

As part of the implementation process, our internal control experts will guide you through completing this important step of the process. We know what questions to ask and how to get this step done in the most efficient and effective way possible. We even offer CPE for the time spent completing your risk assessment. Call to schedule your complementary web-demo today!

Key Features

|

|